In today's rapidly evolving world, where data and information play a crucial role in decision-making, it is imperative for family offices to embrace technology and establish efficient systems. With the right infrastructure and family office technology, one can streamline operations, enhance data management, improve collaboration, and ultimately secure long-term success.

In the third part of our How to Start a Family Office blog series, we explore the key areas where technology can revolutionise family office management and offer insights on how to become a technology leader rather than a laggard.

Data Aggregation and Management

Accurate and timely information is the lifeblood of any family office. With robust data management platforms, family offices can automate data collection, integrate information from multiple sources, and generate real-time reports. This offers them critical insights, facilitating informed investment decisions, risk management, and strategic planning.

By investing in advanced data aggregation tools and platforms, family offices can eliminate manual data entry, reduce errors, and ensure data integrity. These systems can also enhance compliance and regulatory reporting, simplifying the process of meeting legal obligations and ensuring transparency.

Investment Tracking and Reporting

Tracking and monitoring investments can be a complex task, especially when dealing with diverse portfolios and multiple asset classes. However, technology can simplify this process by offering specialised investment tracking and reporting solutions.

Advanced investment tracking systems provide real-time updates, performance benchmarks, and customisable reports and empower family offices to track key performance indicators, compare investment strategies, and make data-driven decisions.

Accounting and Financial Management

Accurate financial management is paramount for family offices to maintain control over their assets and ensure compliance with financial regulations. Implementing robust accounting software helps automate financial processes.

By leveraging technology for accounting and financial management, family offices can minimise manual errors, improve efficiency, and enhance data security. Integrated systems enable seamless collaboration between internal teams and external advisors, facilitating a streamlined financial workflow.

Team Collaboration and Communication

Efficient collaboration is essential for family offices with diverse teams working together towards common goals. With the right collaboration tools, family offices can break down silos, foster transparency, and encourage effective teamwork.

Collaboration tools enhance communication and allow team members to work together seamlessly, irrespective of their physical location, ensuring everyone has access to the most up-to-date information.

Picking the Right Family Office Technology

Embracing technology infrastructure enables family offices to harness the power of data, streamline processes, improve collaboration, and ultimately serve their stakeholders more effectively. By leveraging technology's transformative potential, family offices can position themselves for continued growth and prosperity in an ever-evolving financial landscape.

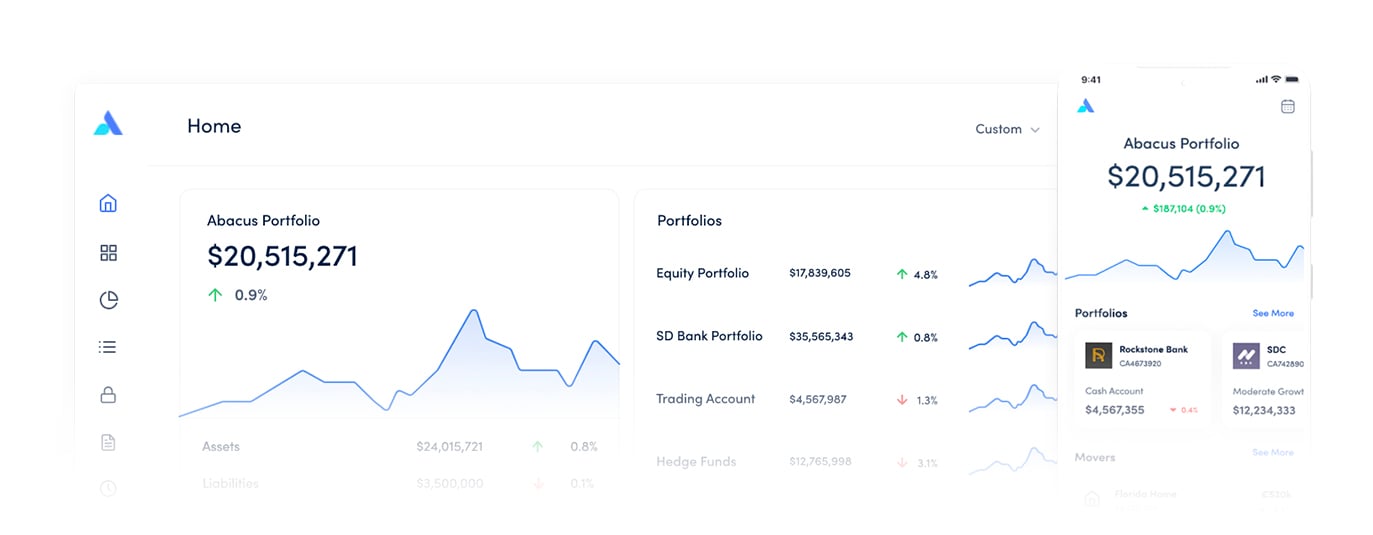

The Asora platform is designed to empower your family office. It allows you to automate data, collaborate with your team, monitor performance against benchmarks, share documents, and manage assets – all on the go.

To learn more, schedule a demo.