In the ever-evolving landscape of wealth management, one of the most significant challenges that both advisors and clients face is the absence of a single source of truth. This absence can create a myriad of difficulties, ranging from inefficiencies in decision-making to potential inaccuracies in financial planning. In this blog post, we'll explore why establishing a single source of truth is crucial for your family office's success and how it can alleviate the challenges posed by fragmented data.

The Trouble with Fragmented Data

Wealth management encompasses a broad spectrum of financial activities, including investments, estate planning, tax management, and more. Each of these areas generates its own set of data points, from bank statements and investment portfolios to legal documents and tax records. Without a centralised platform to integrate and organise this data, advisors and clients are left grappling with fragmented information scattered across various systems and documents.

Challenges Faced Due to Lack of Single Source of Truth

Inefficient Decision-Making:

When data is fragmented, accessing and analysing information becomes a cumbersome process. Advisors may spend valuable time gathering data from disparate sources rather than focusing on strategic decision-making. This inefficiency can lead to missed opportunities or delayed responses to market changes.

Risk of Inaccuracy:

Manual data entry and reconciliation increase the likelihood of errors in financial reporting and analysis. Without a single source of truth to verify data integrity, advisors may inadvertently make decisions based on incomplete or outdated information, exposing clients to unnecessary risks.

Compliance Concerns:

In regulated industries like wealth management, compliance with legal and regulatory requirements is paramount. The absence of a centralised data repository makes it challenging to track and audit client transactions, potentially exposing firms to compliance violations and legal repercussions.

The Role of Family Office Software

Family office software addresses the challenges posed by the lack of a single source of truth by providing a comprehensive platform for data aggregation, analysis, and reporting. Here's how:

Centralised Data Repository:

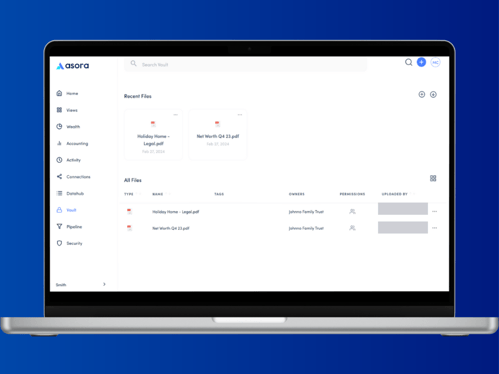

Family office software serves as a centralised hub for storing and managing all client-related data, including financial accounts, assets, liabilities, and documents. By consolidating information in one place, advisors can access real-time insights and make informed decisions more efficiently.

Data Integration and Automation:

Modern family office software integrates with various financial institutions and third-party applications to automatically import and reconcile data. This automation streamlines data management processes, reduces manual errors, and ensures data consistency across the platform.

Advanced Reporting and Analytics:

With robust reporting and analytics capabilities, family office software empowers advisors to gain deeper insights into client portfolios, performance metrics, and financial trends. Customisable dashboards and interactive visualisations enable advisors to communicate complex financial information effectively to clients.

Enhanced Security and Compliance:

Family office software incorporates robust security measures to safeguard sensitive client data and ensure regulatory compliance. Features such as role-based access control, encryption, and audit trails help mitigate security risks and demonstrate adherence to industry standards.

The Importance of a Single Source of Truth in Wealth Management

In today's fast-paced wealth management environment, the lack of a single source of truth can impede efficiency, accuracy, and compliance.

Family office software emerges as the ideal solution to counter this issue by providing a centralised platform for data aggregation, automation, and analysis.

By leveraging the capabilities of family office software, advisors can enhance their ability to deliver personalised financial solutions and empower clients to achieve their wealth management goals with confidence.

Asora is a SAAS solution for single and multi-family offices to track and oversee assets, automating data capture and providing digital on-demand reporting on the web and mobile.

To learn more, schedule a demo with us.