The landscape of investing is continually evolving, and as the world becomes increasingly aware of the environmental and social challenges we face, the importance of responsible and sustainable investing has grown significantly. Family offices, which manage the wealth of high-net-worth individuals and families, are no exception to this trend. In recent years, Family Offices have recognised the pivotal role that ESG (Environmental, Social, and Governance) factors play in making investment decisions. This blog post explores the growing influence of ESG factors in family office investing, emphasising how they are becoming more than just a trend but a cornerstone of sound financial management.

Understanding ESG

ESG stands for Environmental, Social, and Governance. These factors encompass a range of criteria that investors use to evaluate a company's impact on society and the environment.

- Environmental: These criteria assess a company's impact on the environment. This includes factors like carbon emissions, energy efficiency, waste management, and sustainable sourcing of materials.

- Social: Social criteria evaluate a company's relationships with its employees, suppliers, customers, and the communities in which it operates. This includes diversity and inclusion, labour practices, and community engagement.

- Governance: Governance criteria examine a company's internal policies and structures, focusing on issues like executive compensation, shareholder rights, and overall transparency.

ESG Factors as Risk Mitigation

Family offices, like any other investors, are primarily concerned with generating returns on their investments. However, ESG factors have proven to be an effective means of mitigating risks. For example, companies with poor environmental practices may face legal and regulatory challenges, as well as reputational damage. A family office that takes ESG factors into account is better equipped to avoid investing in businesses that may become entangled in such controversies.

Furthermore, a focus on good governance can help protect a family's investment by reducing the likelihood of corporate scandals or mismanagement. By considering social factors, family offices can identify companies that treat their employees and communities well, which can lead to more stable and sustainable business operations.

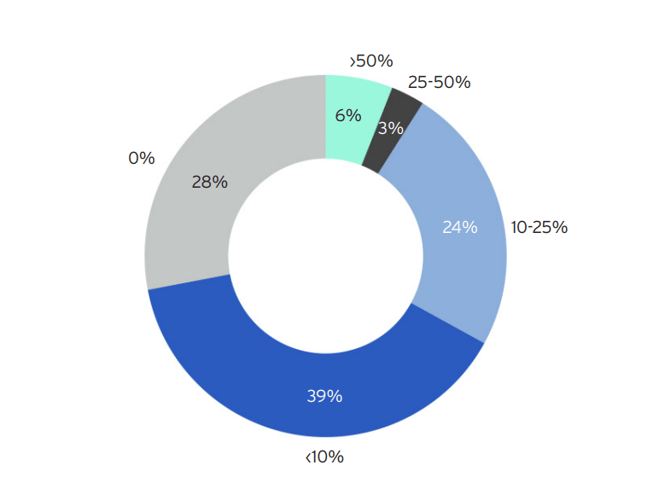

"Two-thirds of family offices have zero (28%) or less than 10% (39%) of their portfolios allocated to sustainable investments. This represents an improvement, since 77% of respondents fell into one of these categories last year."

Beyond Risk

While mitigating risks is essential, ESG factors can also enhance returns, which is a crucial objective for family offices. Several studies have suggested that companies with strong ESG performance tend to outperform their peers in the long run.

- Environmental Innovation: Companies that prioritise environmentally friendly practices often find opportunities for innovation, cost savings, and new revenue streams. For example, investing in renewable energy can provide both environmental benefits and financial returns.

- Social Capital: Companies with strong social responsibility practices tend to attract and retain top talent, fostering a motivated and productive workforce. Happy employees are more likely to drive a company's success.

- Ethical and Sustainable Business Models: Consumers and investors increasingly prefer businesses that align with their values. Family offices investing in companies that do good are more likely to benefit from growing consumer and investor interest.

ESG Integration in Family Office Investing

The integration of ESG factors into the investment process varies among family offices. Some take a more exclusionary approach, excluding industries like tobacco, weapons, or fossil fuels from their portfolios. Others adopt a more holistic approach, seeking investments that actively contribute to positive ESG outcomes.

- Screening and Exclusion: Some family offices choose to exclude companies involved in controversial industries or with poor ESG records. This approach aligns investments with the family's values and minimises exposure to certain risks.

- Integration: Many family offices opt for the integration of ESG factors into their traditional investment analysis. They consider these factors alongside traditional financial metrics to make more informed investment decisions.

- Impact Investing: A growing number of family offices are venturing into impact investing, where their investments are deliberately selected to generate measurable social and environmental benefits alongside financial returns.

ESG in Family Offices

In the world of family office investing, the role of ESG factors has evolved from being a mere trend to becoming a fundamental consideration in the decision-making process. The integration of ESG criteria not only helps family offices manage risks effectively but also positions them to potentially enhance returns. As the world continues to grapple with environmental and social challenges, family offices are recognising their responsibility to shape a more sustainable and responsible future through their investment choices. In this context, ESG factors are no longer a choice but an integral part of prudent and forward-looking family office investment strategies.

Asora is a SAAS solution for single and multi-family offices to track and oversee assets, automating data capture and providing digital on-demand reporting on the web and mobile.

To learn more, schedule a demo with us.